Best CD Rates In Arizona How To Choose The Right Bank For You

Ditch chump change, choose smart! Navigate Arizona's top best cd rates in Arizona & snag the perfect bank for effortless interest growth

David Mitchell

Dec 26, 2023

Certificate of Deposit (CD) rates are on the rise even though Arizona's sweltering summer is coming to an end. Now that change is in the air, Arizonans have the opportunity to finally watch their money grow after years of disappointing returns.

The days of accepting meager interest nibbles are long gone. Good CD rates are now available throughout the state, giving individuals' personal finances a much-needed boost. A high-yield CD can make all the difference in your financial plans, whether you're saving for a dream vacation, an emergency fund, or retirement.

What makes these rates so significant, though? To put it briefly, CD rates are what primarily drive your savings growth. The more quickly you accomplish your financial objectives, the higher the rate since money accumulates more quickly. Having a high-yield CD helps you remain ahead of the curve, which is especially important in a world where inflation is eating away at purchasing power.

On the other hand, it might be challenging to navigate the Arizona CD landscape. Choosing the best bank can be likened to navigating a desert sandstorm due to the diverse terms, rates, and amenities that each provides. Be at ease; we are going to act as your reliable compass, assisting you in navigating the complexities of Arizona's CD market and locating the ideal haven for your funds.

A deeper look at Arizona's current CD rates will be covered, along with the options explained and the resources you need to make decisions that will support your financial future Stay tuned.

What Are CDs And How Do They Work

Think of a CD as a savings account with a superpower guaranteed interest. It's like making a deal with your bank you stash your cash away for a set period (think sunshine vacation or retirement countdown), and in return, the bank promises to pay you a fixed rate of interest, like a juicy bonus on top.

Here's How It Works

- Deposit Day -You choose your CD term (think 6 months, 1 year, or even 5 years) and lock in your interest rate.

- Savings on Autopilot -Tuck your money away, and it starts earning interest like clockwork. Imagine it growing like a desert cactus under the warm Arizona sun.

- Guaranteed Growth -No more guessing! You know exactly how much your savings will swell by the end of your term, making budgeting a breeze.

- Early Bird Gets a Penalty -Breaking your CD promise (like leaving your cactus thirsty) comes with a fee, so think twice before dipping in early.

But Why Choose A CD Over A Regular Savings Account? Here's The Magic

- Higher Interest Rates -CDs typically offer significantly higher rates than regular savings, making your money grow faster. Think of it as trading in your rusty watering can for a high-tech irrigation system!

- Predictability -You know exactly what you'll earn, taking the guesswork out of your financial planning. No more squinting at stock charts under the desert sun!

- Low-Maintenance Growth -Just deposit and relax. CDs are the perfect "set it and forget it" tool, letting your money work for you while you enjoy the Arizona sunshine.

Of Course, There Are Some Things To Keep In Mind

- Locked-in Funds -Remember, your money is unavailable until the CD matures. Think of it like burying your treasure for safekeeping you can't dig it up every day.

- Interest Rate Fluctuations -Rates can change, so compare options before locking in your CD.

- Penalty Fees -Early withdrawals can come with a cost, so plan your needs carefully.

Overall, CDs are a fantastic tool for anyone who wants to give their savings a boost, especially in Arizona's competitive CD market. Just remember, it's like planting a seed in the desert choose the right term, nurture it with patience, and watch your financial oasis blossom.

Factors Affecting CD Rates In Arizona

The melody of CD rates in Arizona is a complex tune, played by a diverse orchestra of factors. Let's break down the main instruments.

- The Federal Reserve's Baton -Just like a conductor sets the tempo, the Federal Reserve's interest rate plays a crucial role. When the Fed raises rates, Arizona banks tend to follow suit, potentially offering higher CD rates to attract deposits. Conversely, lower Fed rates can dampen the Arizona CD market.

- The Local Economic Drumbeat -Arizona's economic health also plays a vital role. A strong economy with robust job growth and low unemployment can fuel higher CD rates as banks compete for deposits. Conversely, an economic downturn might lead to lower rates as banks tighten their belts.

- The Bank's Individual Solo -Each bank has its own unique strategy, like a virtuoso musician. Some banks prioritize attracting new customers with higher rates, while others may focus on existing clients or offer lower rates due to lower operating costs. Additionally, the bank's overall financial health can influence its CD offerings.

- The Competitive Chorus -The harmony of competition also shapes the melody. When multiple banks vie for deposits, they might offer higher rates to stand out. This creates a dynamic market where Arizonans can potentially find the most lucrative options.

- The Term and Tenor -Just like the length of a musical phrase affects the melody, the CD term (duration) impacts the rate. Generally, longer terms offer higher rates, as banks reward your commitment with a sweeter tune.

Understanding this interplay of factors empowers you to navigate the Arizona CD market like a seasoned maestro. By considering the overall economic climate, individual bank strategies, and CD term options, you can find the perfect harmony for your savings goals. Remember, the right CD rate can be the key to making your financial dreams sing.

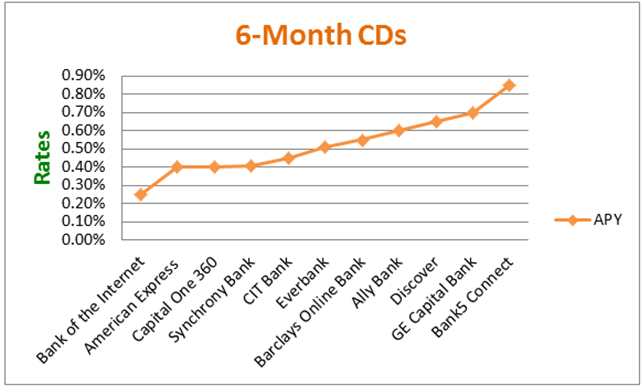

Comparison Of Current CD Rates Offered By Arizona Banks

However, I can still offer you some resources to help you compare current CD rates in Arizona

- Online Comparison Tools -Websites like Bank rate, Deposit Accounts, and Money Rates allow you to filter and compare CD rates from various banks and credit unions in Arizona, including different term lengths and minimum deposit requirements.

- Individual Bank and Credit Union Websites -Most banks and credit unions list their current CD rates on their websites. This can be a good way to see what offerings are available from specific institutions you're interested in.

- Financial Advisors -If you're looking for more personalized guidance, consider consulting with a financial advisor. They can help you assess your financial goals and compare CD options based on your unique needs and risk tolerance.

Here Are Some Additional Tips For Comparing CD Rates

- Focus on APY (Annual Percentage Yield) -This takes into account both the stated interest rate and compounding, giving you a more accurate picture of your total earnings.

- Consider Fees -Some CDs may have early withdrawal penalties or other fees. Be sure to factor these in when comparing rates.

- Think about your needs -Choose a CD term that aligns with your savings goals and risk tolerance.

- Shop around -Don't just settle for the first CD you find. Take some time to compare rates from different institutions before making a decision.

How To Choose The Best CD Tips For Savers In Arizona

Finding the perfect CD is like composing a financial masterpiece every note, from term length to early withdrawal penalties, needs to harmonize with your individual goals. Let's break down the key instruments in this financial orchestra.

Term Length The Rhythm Of Your Goals

- Short-term goals (1-2 years) -opt for shorter terms like 6 months or 1 year for easy access and flexibility. Think emergency fund or upcoming vacation savings.

- Medium-term goals (3-5 years) -Consider terms like 3 or 5 years to balance accessibility with higher potential returns. Ideal for down payments or education savings.

- Long-term goals (5+ years) -Embrace longer terms like 7 or 10 years for maximum interest growth. Perfect for retirement or future investments.

Early Withdrawal Penalty The Harsh Dissonance

Remember, breaking your CD promise comes with a cost, like a jarring off-key note. Understand the penalty fees for early withdrawals and ensure your chosen term aligns with your potential needs.

Interest Compounding - The Sweet Harmony Of Growth

The magic of compounding interest is like a beautiful crescendo, allowing your money to snowball over time. Choose CDs with frequent compounding (monthly or quarterly) to maximize your returns, especially for longer terms.

Beyond The Basics

- Minimum deposit requirements -Ensure you have the required minimum amount to open your desired CD.

- Renewal options -Some CDs automatically renew at the end of their term, while others require manual action. Choose what suits your needs and preferences.

- Bank stability -Research the bank's financial health and reputation for added peace of mind.

Composing Your Financial Symphony

- Identify your goals -What are you saving for? How soon will you need the money?

- Assess your risk tolerance -How comfortable are you with locking your funds away?

- Research and compare -Compare rates, terms, and fees from different banks and credit unions.

- Read the fine print -Understand all terms and conditionsbefore committing.

- Monitor your progress -Regularly review your CD and adjust your strategy as needed.

Remember, the best CD is the one that harmonizes perfectly with your financial goals and risk tolerance. By carefully choosing the right notes, you can compose a beautiful melody of growth and success for your savings.

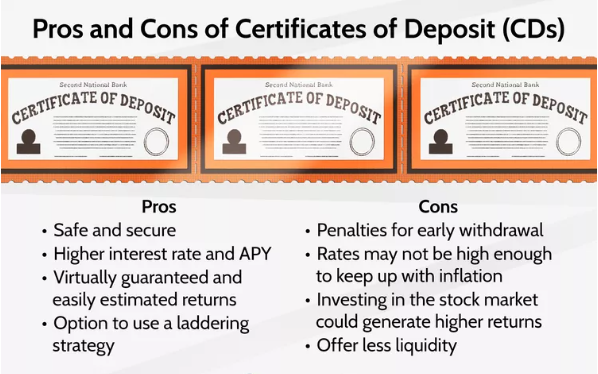

Pros And Cons For CD Rates

When it comes to choosing the right bank for your Arizona CD, the melody shifts between online and local institutions. Each offers its own set of advantages and limitations, and the perfect harmony depends on your unique financial needs and preferences. Let's compare the notes online Banks.

Benefits

- Higher CD Rates -Generally, online banks boast higher rates due to lower overhead costs. This can significantly boost your savings growth, especially over longer terms.

- Convenience -24/7 access via mobile apps and online platforms allows you to manage your CD on your own terms, anytime, anywhere. No need to hunt for parking at the bank!

- Fewer fees -Online banks often have fewer or lower fees than local banks, leaving more of your hard-earned money in your pocket.

Disadvantage

- Limited personal touch -No physical branches mean less face-to-face interaction with bank representatives. This can be a drawback for those who prefer personalized advice and assistance.

- Technology dependence -Managing your CD relies on internet access and digital platforms. This might not be ideal for everyone, especially tech-averse individuals.

- Potential security concerns -While online banks employ robust security measures, some might be wary of entrusting their savings solely to the digital realm.

Local Banks Benefits

- Personal service -Build relationships with bank representatives who can offer tailored advice and support. This can be invaluable for complex financial situations or those seeking guidance.

- Convenience of physical branches -Depositing cash, accessing safety deposit boxes, and resolving issues in person can be easier with physical branches nearby.

- Familiarity and security -Some prefer the comfort and established reputation of local banks, especially those with a long history in the community.

Drawbacks

- Lower CD Rates -Local banks often offer lower rates than their online counterparts due to higher operating costs. This can translate to slower savings growth.

- Limited hours and locations -Branch hours and availability might not always be convenient, especially if you have a busy schedule or live far from a branch.

- Potential fees -Local banks tend to have more fees than online banks, which can eat into your returns.

Finding The Right Chord

Ultimately, the best bank for your Arizona CD depends on your individual priorities. If maximizing returns and digital convenience are paramount, online banks might be the perfect match. However, if you value personal service, physical accessibility, and established familiarity, local banks might be the more harmonious choice.

Remember, a well-rounded financial strategy often involves diversifying your banking needs. You could maintain a checking account at a local bank for easy access and personal service, while utilizing an online bank's high-yield CD to boost your long-term savings.

Play the right notes with your CD choice, and your Arizona savings will soon be singing a sweet melody of success.

Conclusion

Remember, the perfect CD for your Arizona savings is like a custom-written song – it should resonate with your unique financial goals and preferences. By carefully considering the rhythm of term lengths, the harmony of interest compounding, and the potential dissonance of early withdrawal penalties, you can craft a financial masterpiece that sings sweet tunes of growth and success.

So, whether you choose the convenience and potentially higher rates of online banks, or the familiar touch and accessibility of local institutions, ensure your CD choice aligns perfectly with your financial ambitions. Embrace the symphony of options, and watch your Arizona savings blossom into a beautiful chorus of prosperity.